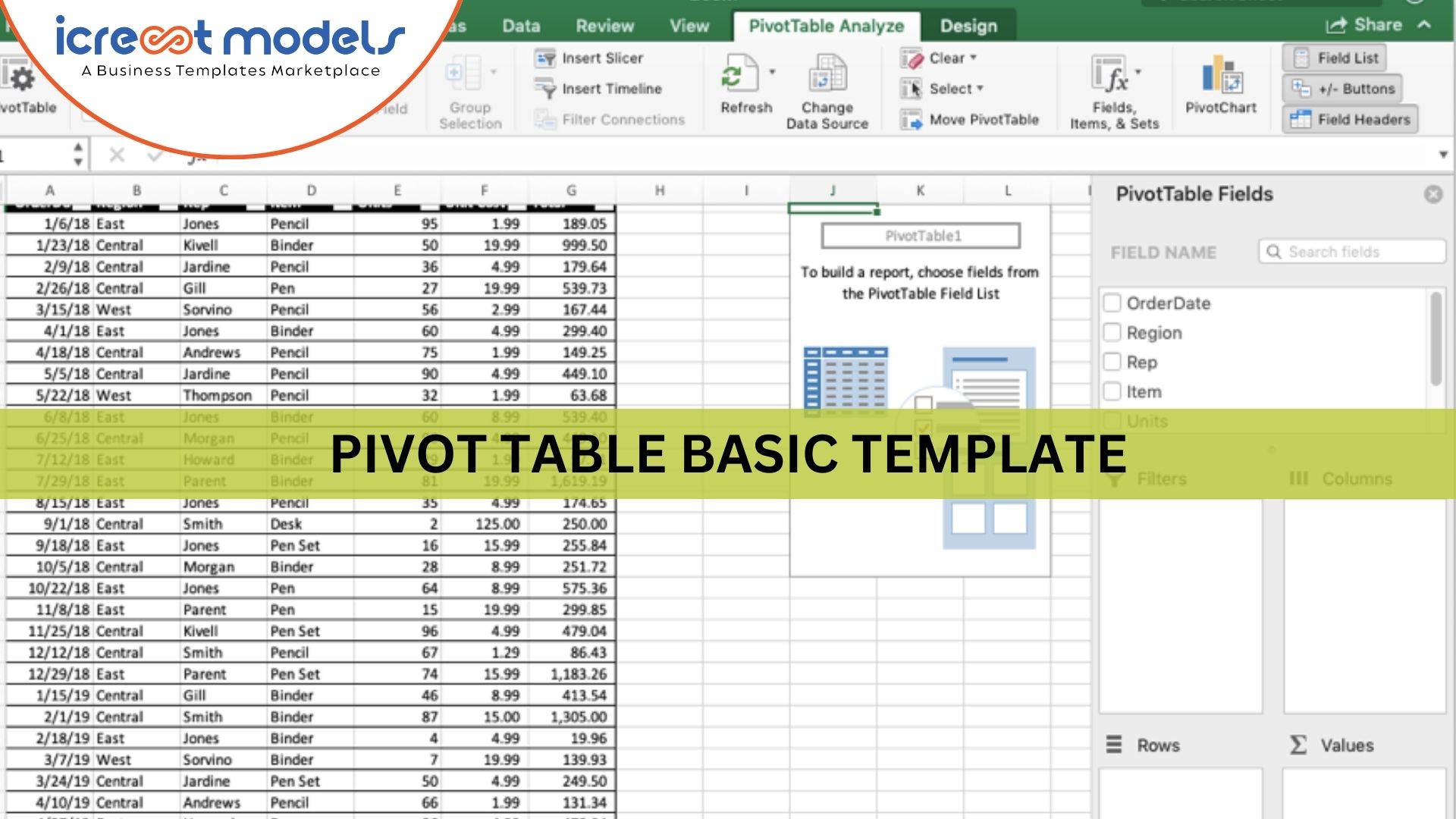

Global Service Based Marketplace for Tools, Templates and Advisory

FACILITATING HIGHLY CURATED industry driven REUSABLE BUSINESS TOOLS and TEMPLATES FROM THE PROFESSIONALS AND EXPERTS WORLDWIDE

WHAT ARE YOU LOOKING FOR?

Start earning passive income as a Vendor / Seller,

OR

, purchase industry driven business tools and templates / take hourly consulting from our international

experts as a Buyer

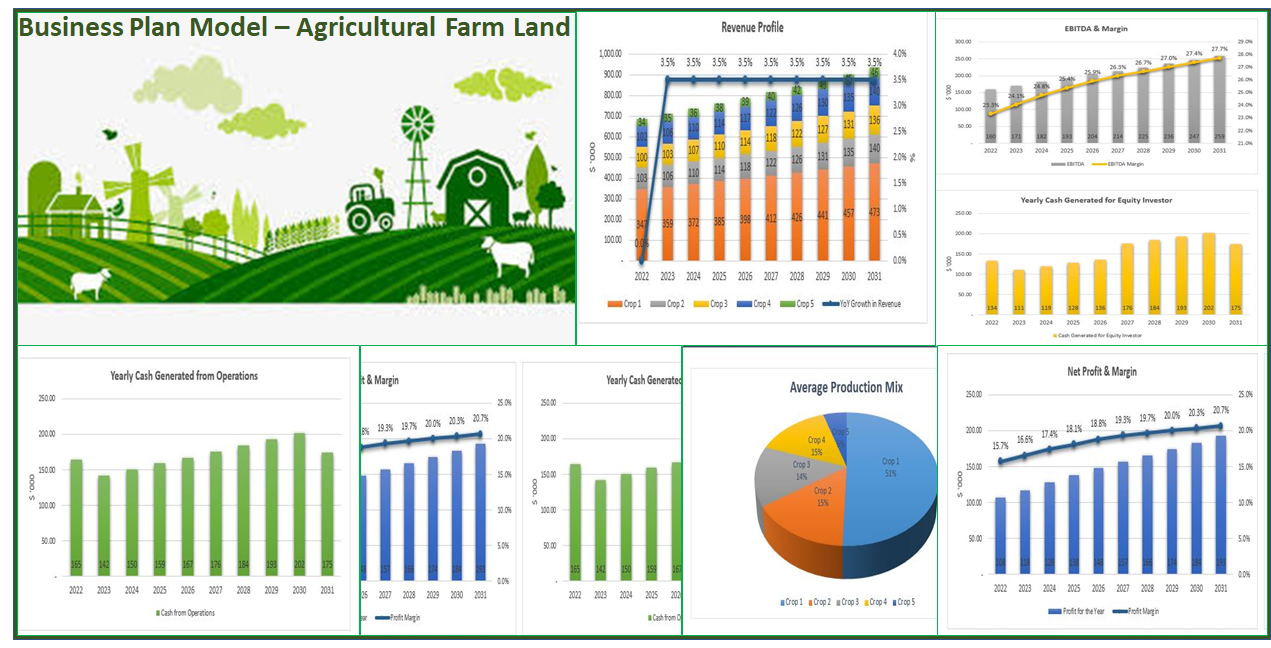

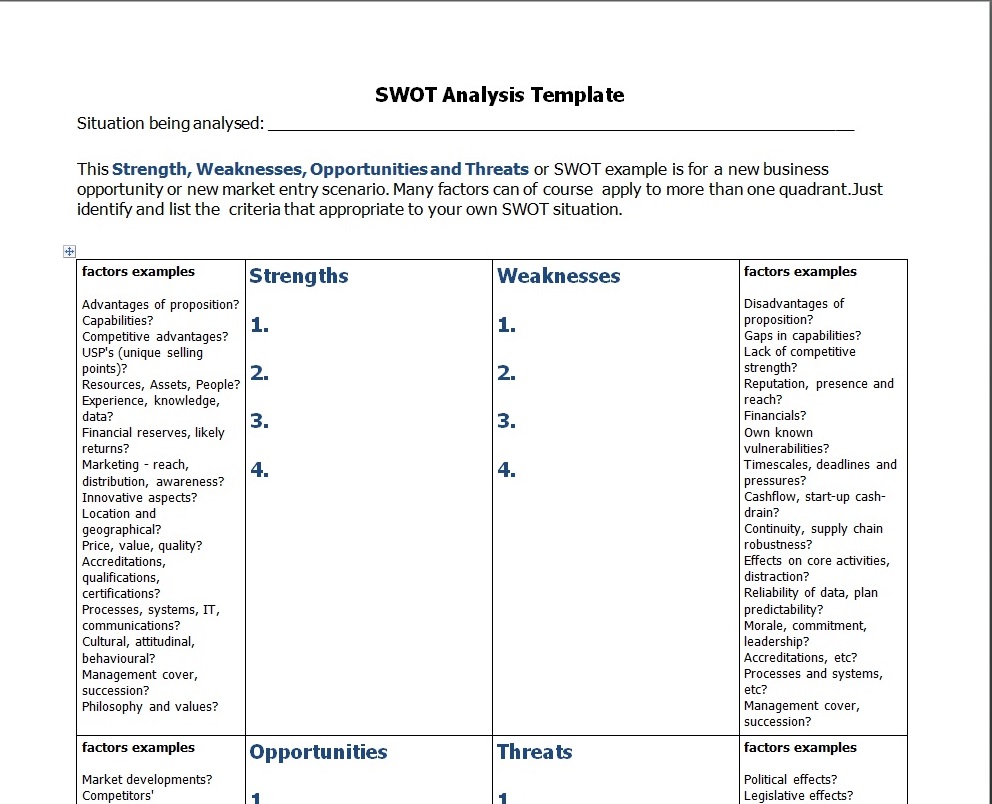

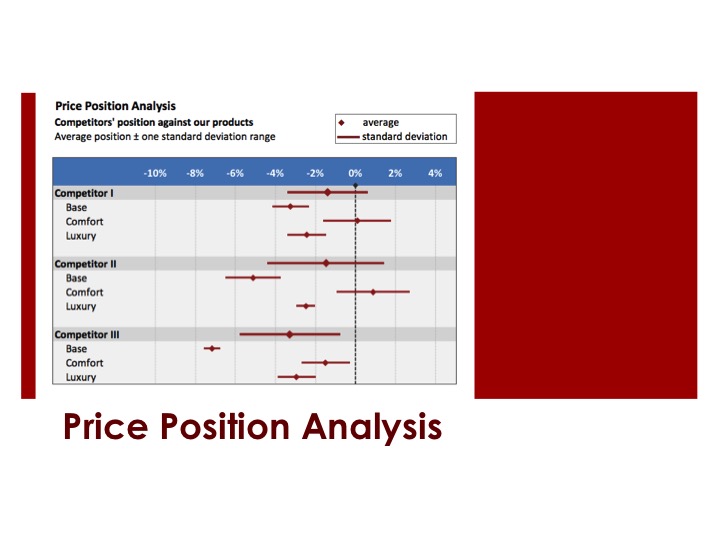

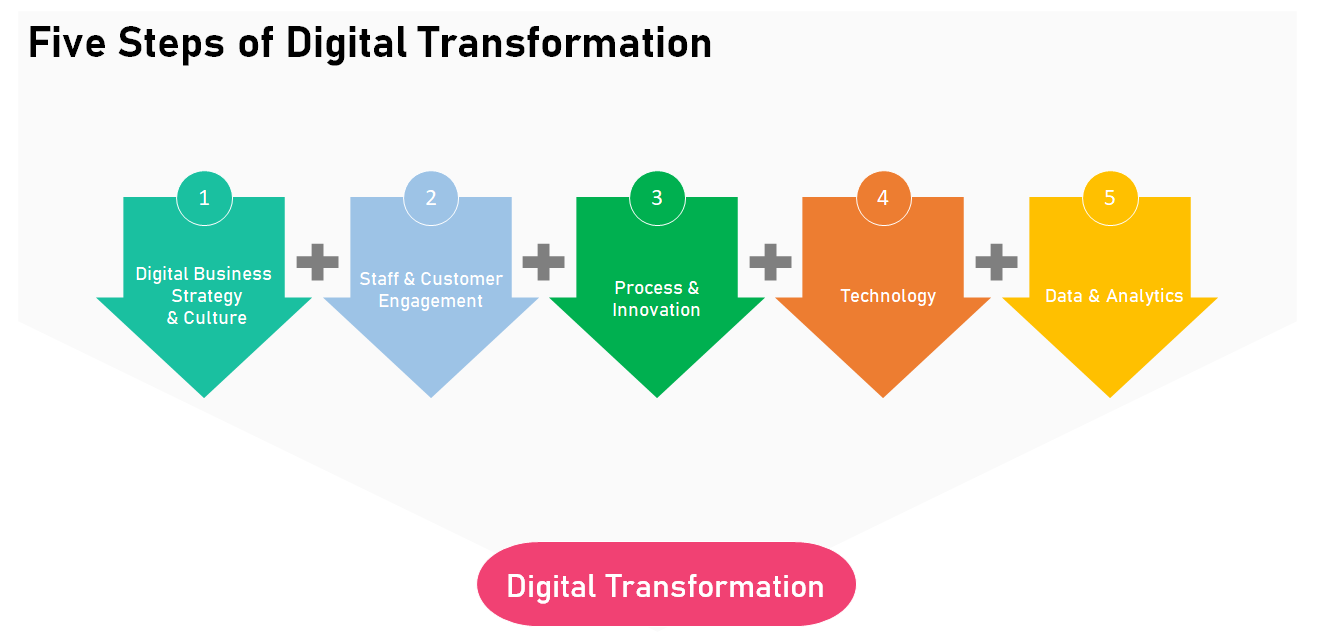

Serviceable Categories

Icrest Models : A tech product of "Infocrest" (A Global Business Planning and Financial Modelling Company), has been launched to support consultants, investment bankers and industry professionals worldwide who are looking to earn passive income by “uploading” and selling their best business tools in the form of reports, models, presentations, and at the same time helping Startups, SMEs, Wannapreneurs, Fellow Business Consultants and University Students worldwide to “buy” these tools at an “unbelievable cost” and reuse them in their business or assisting their clients further or for the purpose of further study, respectively.

Featured Vendors

Jason Varner | SMARTHELPING: Bottom-up Financial Models

Jason Varner | SMARTHELPING: Bottom-up Financial Models

ECF Consultancy

ECF Consultancy

Pitch Books

Pitch Books

Business Consultancy

Business Consultancy

Big4WallStreet

Big4WallStreet

Financial modelling services

Financial modelling services

Testimonials

I am reaching out to thank Yash and Infocrest team for all the support offered to our company success journey. Throughout the years and since day one, Infocrest maintained the highest standards and professional ethics in maintaining our projects. We are enthusiastic every time we receive an update about your new endeavors.

Keep It up and Stay Authentic, All the best for Icrest

Fatima Mahfouz

Managing Director - Creative Solutions Services and Translation LLC, UAE

I have had the pleasure of using Infocrest services for many years to assist me with business plans and financial models. Their ability to understand my needs has been beneficial. This new initiative "Icrest Models" is a very interesting concept, out of box and disruptive. I look forward to interacting with the vendors on this platform towards my future business needs.

Vishal Kodikal

COO, Phoenix Scrap & Metal Waste Trading (Branch of Phoenix Fund Investments LLC), UAE