Real estate financial modeling (REFM) is the process of making financial models to test the viability, risk, and returns of real estate investment. It encompasses cash flow forecasting, determining returns like NPV and IRR, and analyzing financing options. Through the assessment of scenarios and certain market events, analysts, developers, and investors should be able to make informed decisions regarding the project.

Financial planning and forecasting are major determinants of success in the real estate business. Icrest Models has custom real estate financial modeling templates, developed exclusively for purposes in the sector, to help investors and real estate professionals make well-informed decisions while backed by data. Whether mixed-use, residential, or commercial, we have customized models to handle every aspect of any real estate project at hand. Our models go further to give you a clear idea of just how potential your investments can be, helping you minimize risks while maximizing returns based on accurate forecasts, cash flow analysis, and profit projections

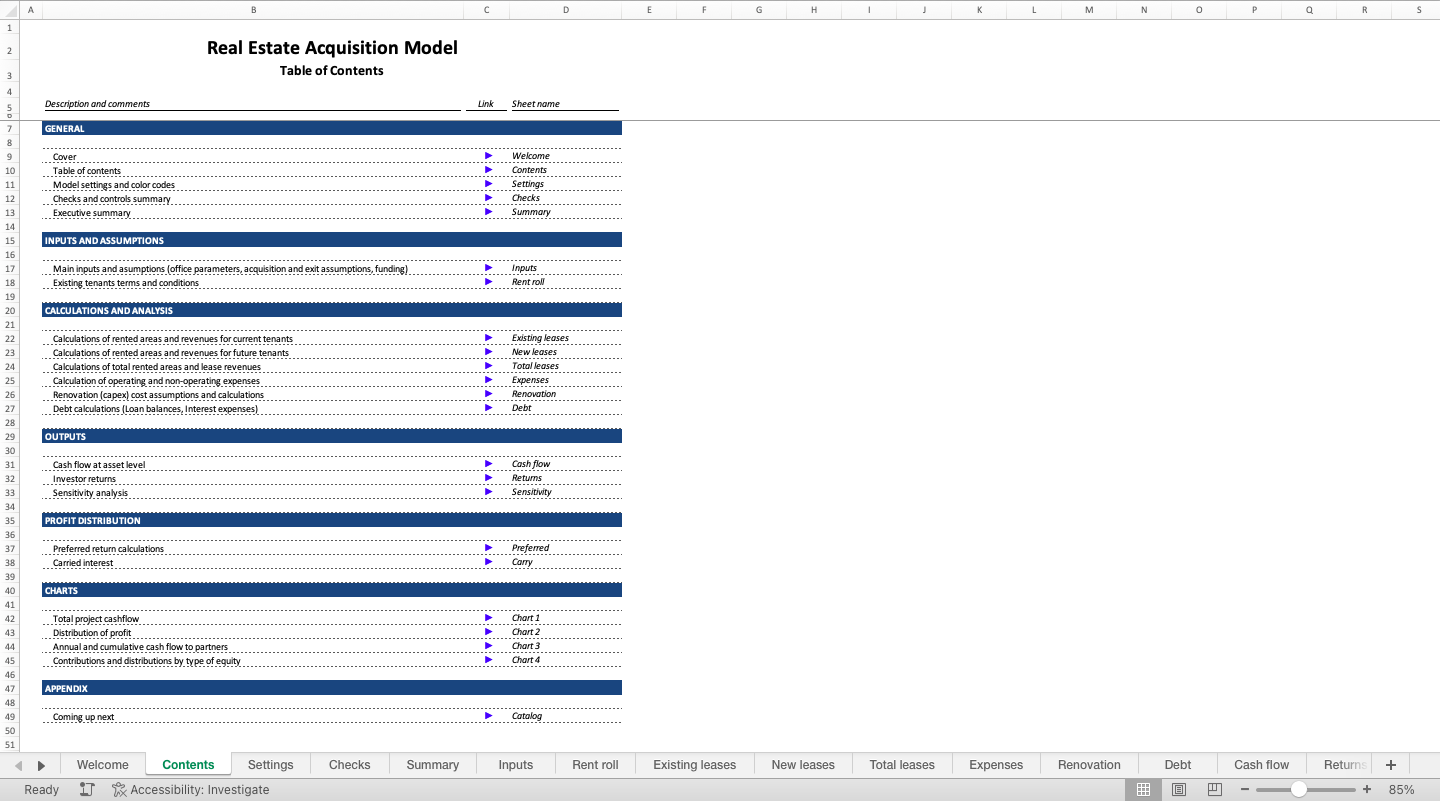

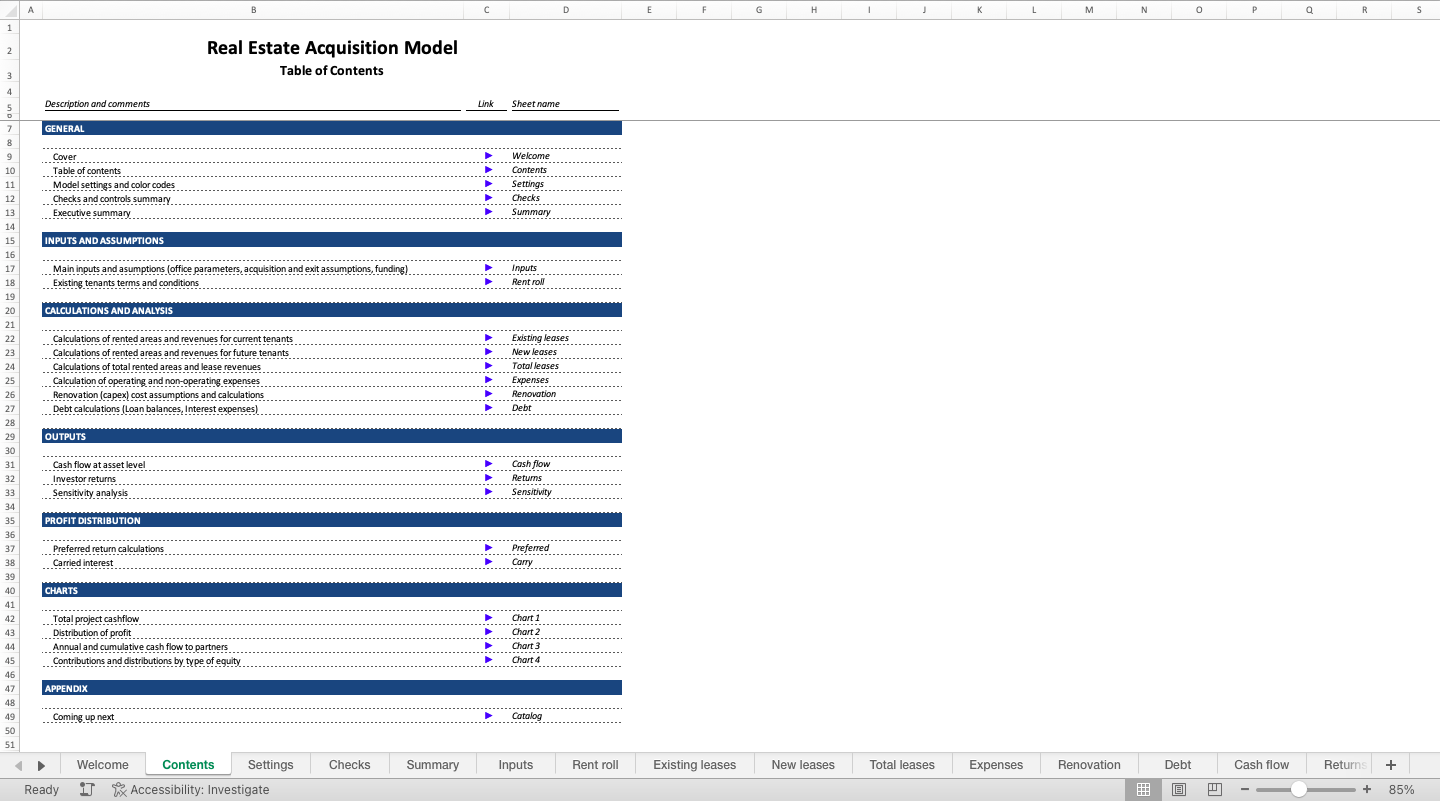

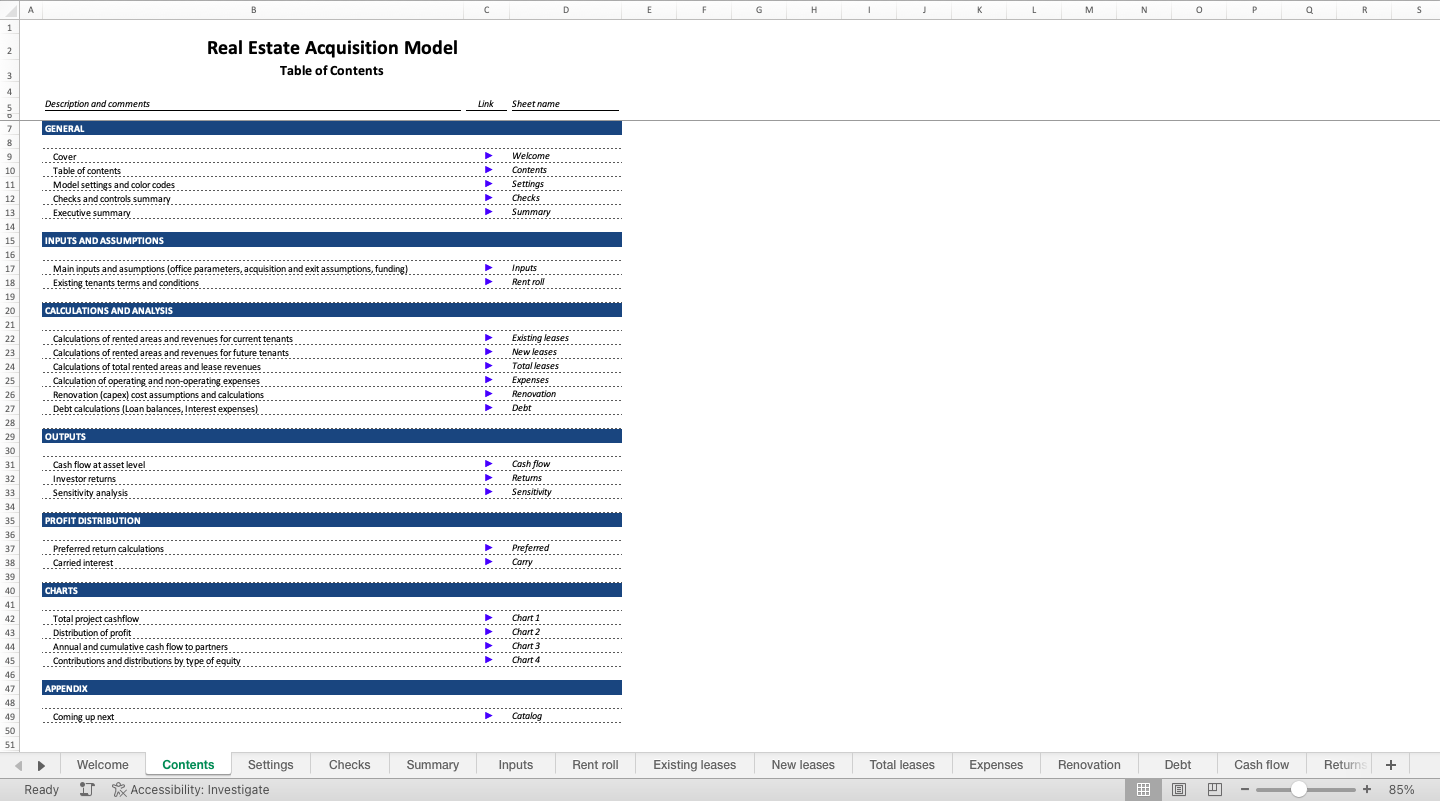

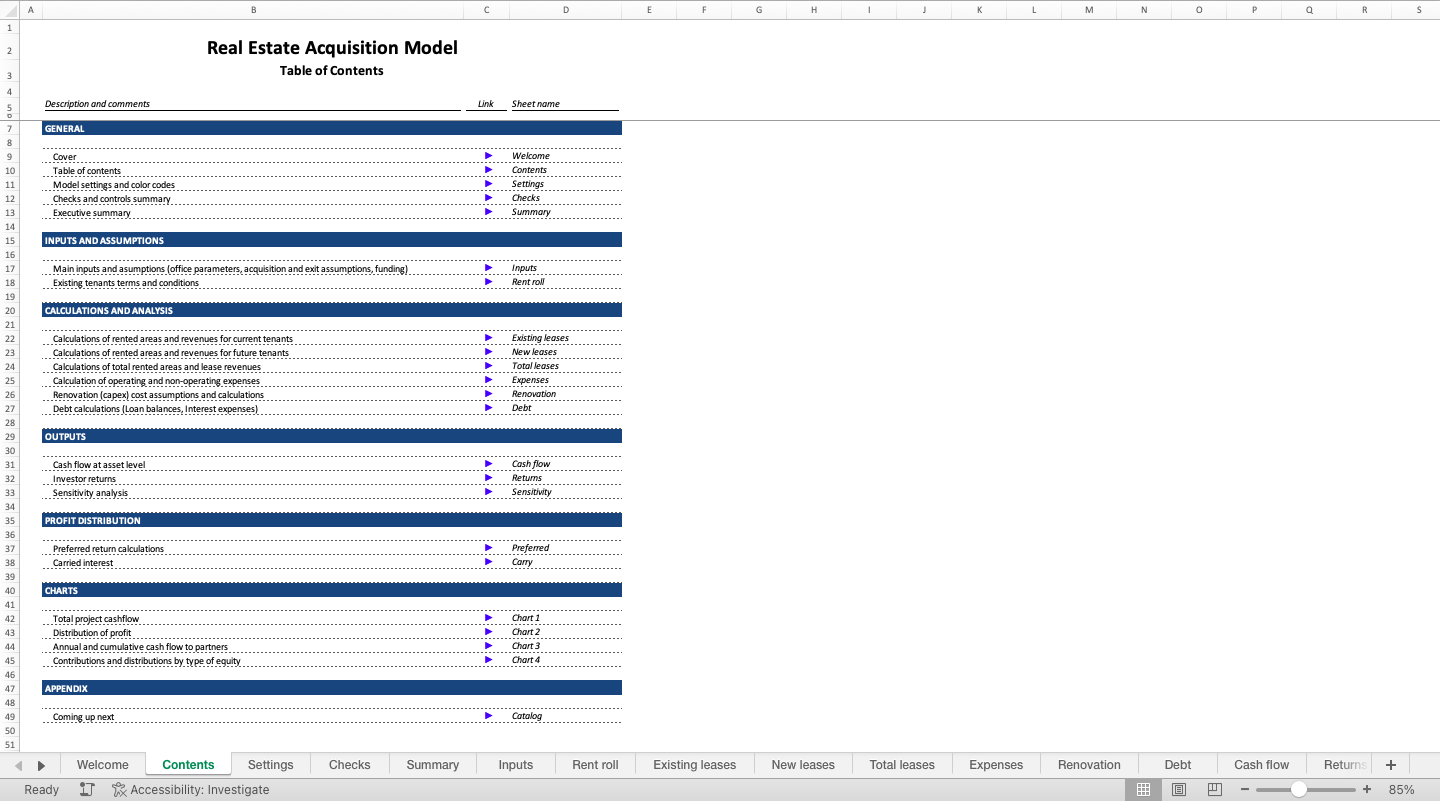

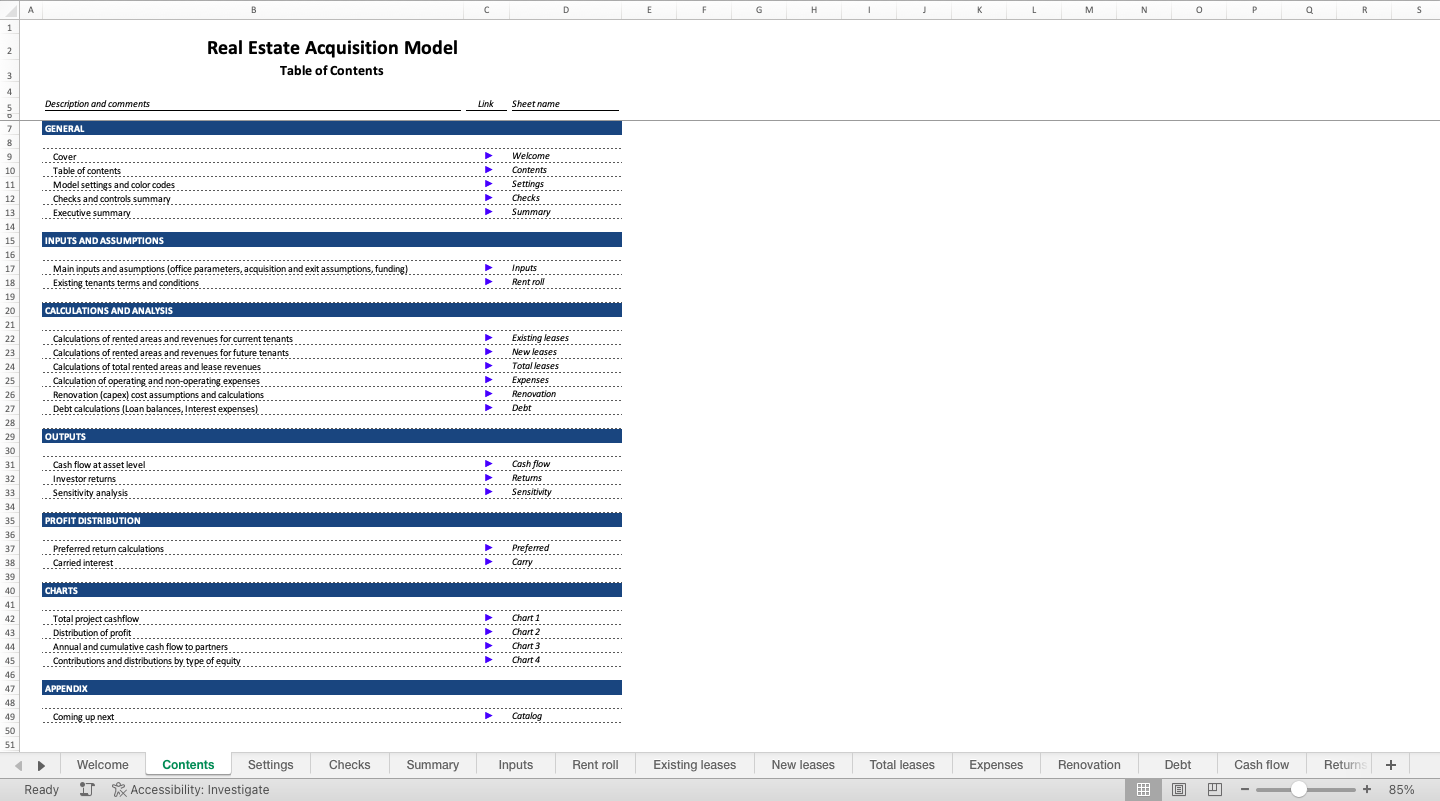

Key Features of Our Real Estate Financial Models

● Comprehensive Cash Flow Analysis: Make sure you have a clear picture of where and when your capital is needed by accurately forecasting cash inflows and outflows throughout the project lifespan.

● Profitability Projections: Use rental revenue, sales, market trends, and appreciation in the property to model the income potential and return on investment of your property.

● Capital Requirements: To help you plan your finance strategy, estimate the amount of money required for building, remodeling, property acquisition, and other significant expenses.

● Risk and sensitivity analysis: evaluate the potential effects of shifting market conditions, interest rates, and other factors on the economic viability of your project by running scenarios.

● Comprehensive Cost Analysis: recognize and budget for all expenses, such as utilities, maintenance, property taxes, and legal costs, to help you avoid unforeseen financial shocks.

● Customizable Assumptions: Our templates allow you to customize key variables, such as property price appreciation, rent escalations, and occupancy rates, to match the particular characteristics of your market.

Why Choose Icrest Models for Your Real Estate Financial Planning?

Every real estate project is different, and we at Icrest Models are aware of this. Our financial models are therefore quite adjustable in addition to being thorough. Whether you're managing a sizable real estate portfolio or analyzing a single investment, our templates provide the flexibility and accuracy you need to make wise financial choices.

Our templates, which were created by experts in the field of finance, guarantee that you have the resources necessary to provide lenders, investors, and other stakeholders with precise and understandable estimates. You may successfully negotiate the challenges of funding, acquisitions, and project development with the guidance of our models.

Who Can Benefit from Our Real Estate Financial Models?

● Real estate developers want to evaluate new ventures' financial feasibility.

● Investors want to manage portfolio performance and assess possible returns;

● Property managers and consultants require comprehensive projections for their customers.

● Financial organizations and lenders are assessing funding options for real estate projects.

Plan Your Real Estate Success with Confidence

Use the professionally designed financial templates from Icrest Models to eliminate risk from your upcoming real estate endeavor. Whether you're investing in large-scale commercial ventures or residential properties, our models assist you in managing risks, optimizing your tactics, and achieving lucrative results.

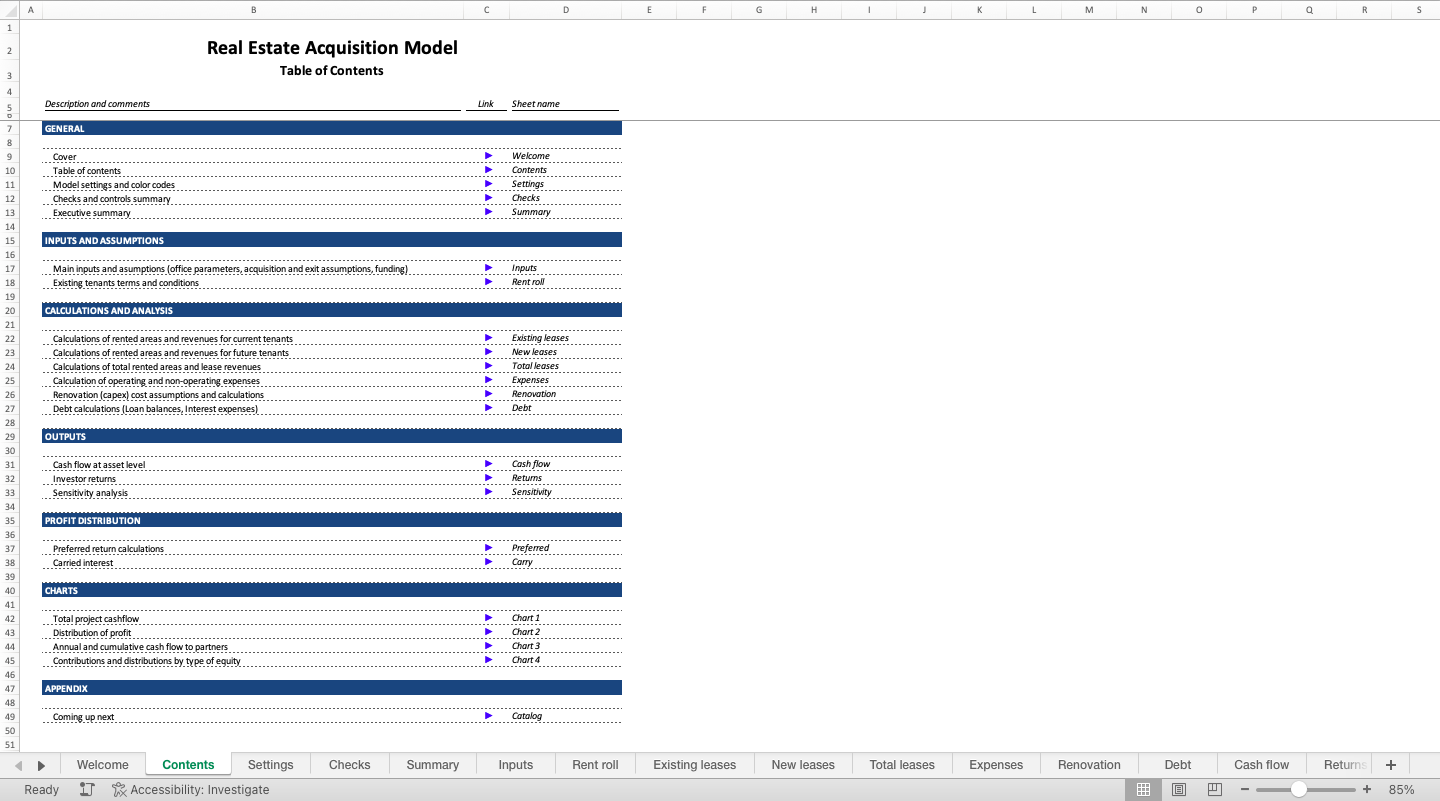

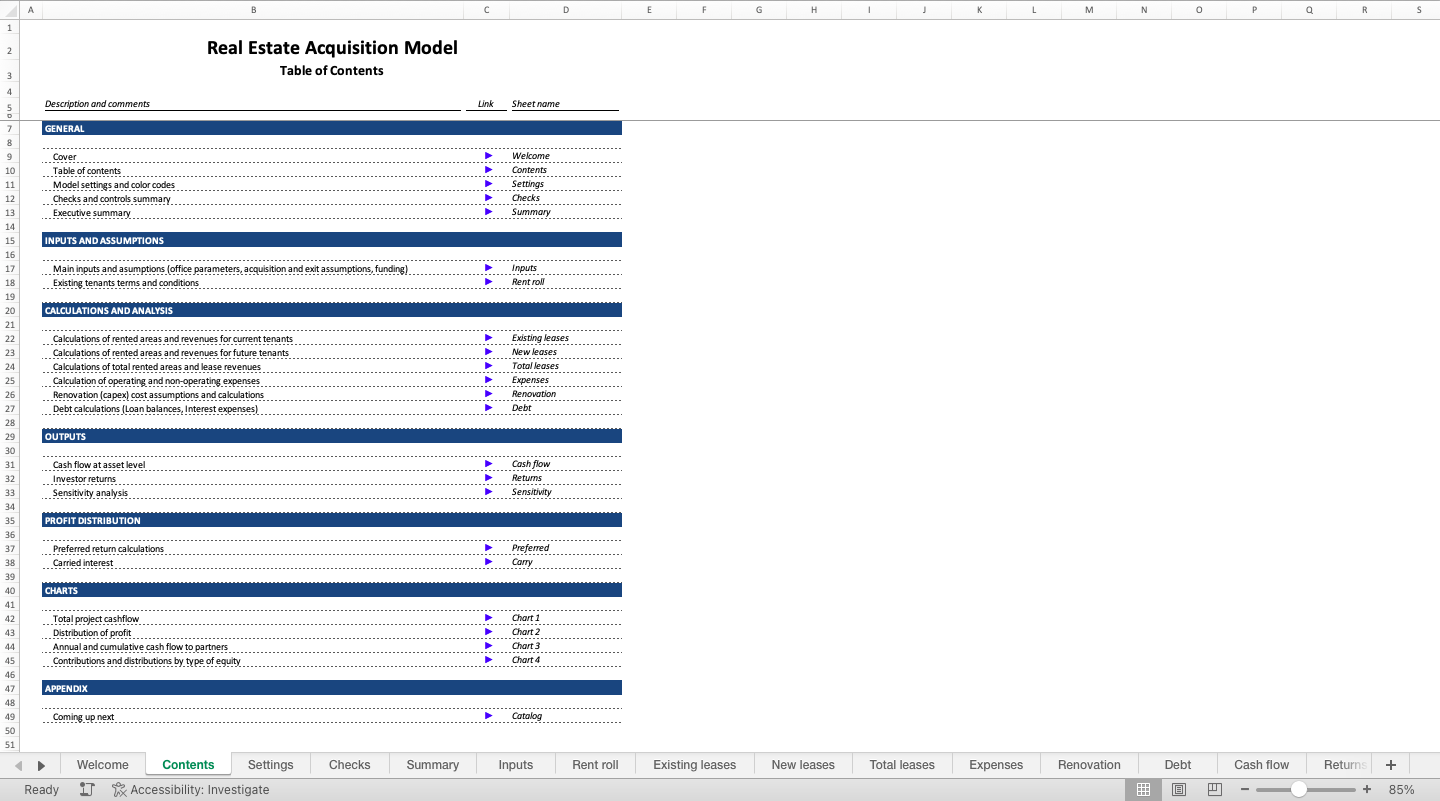

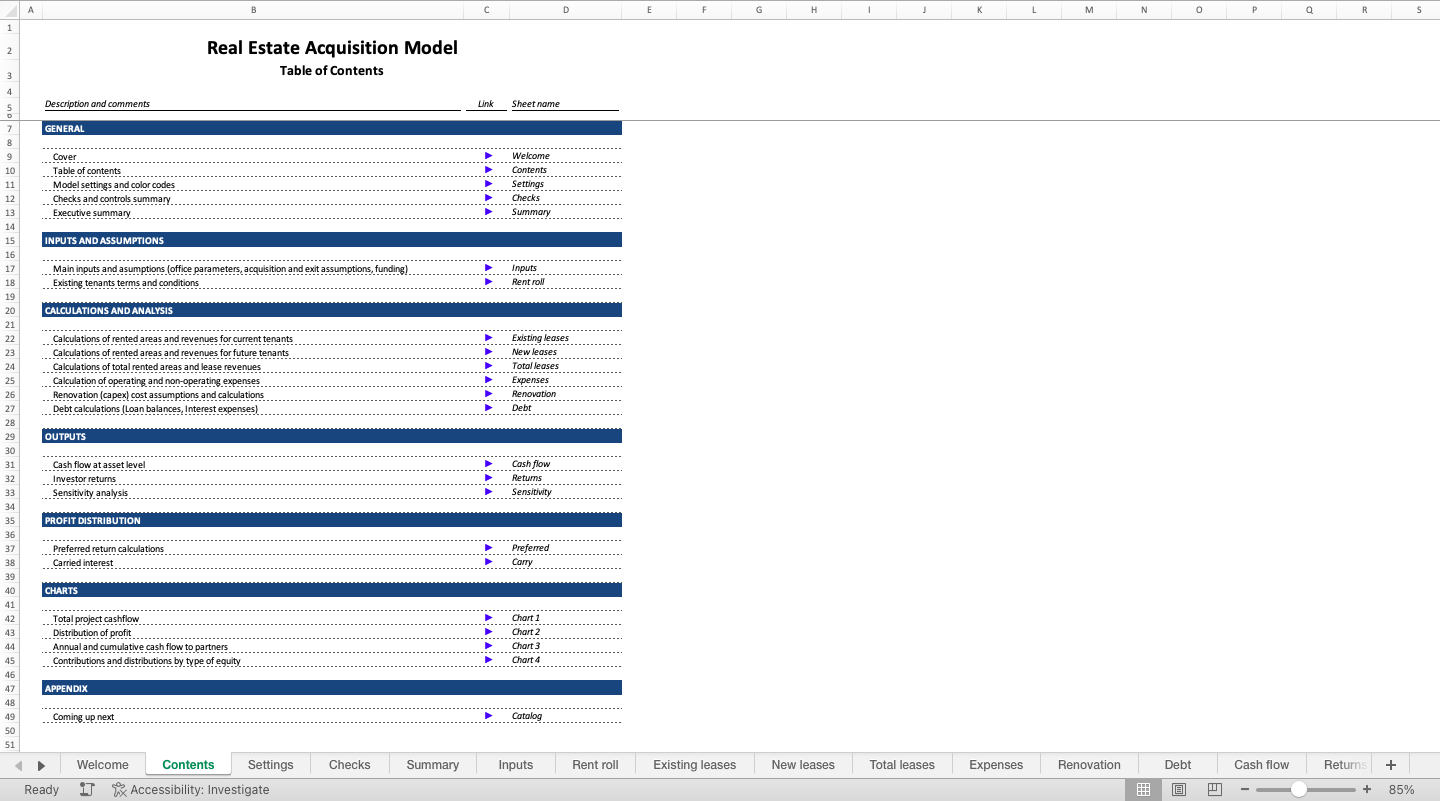

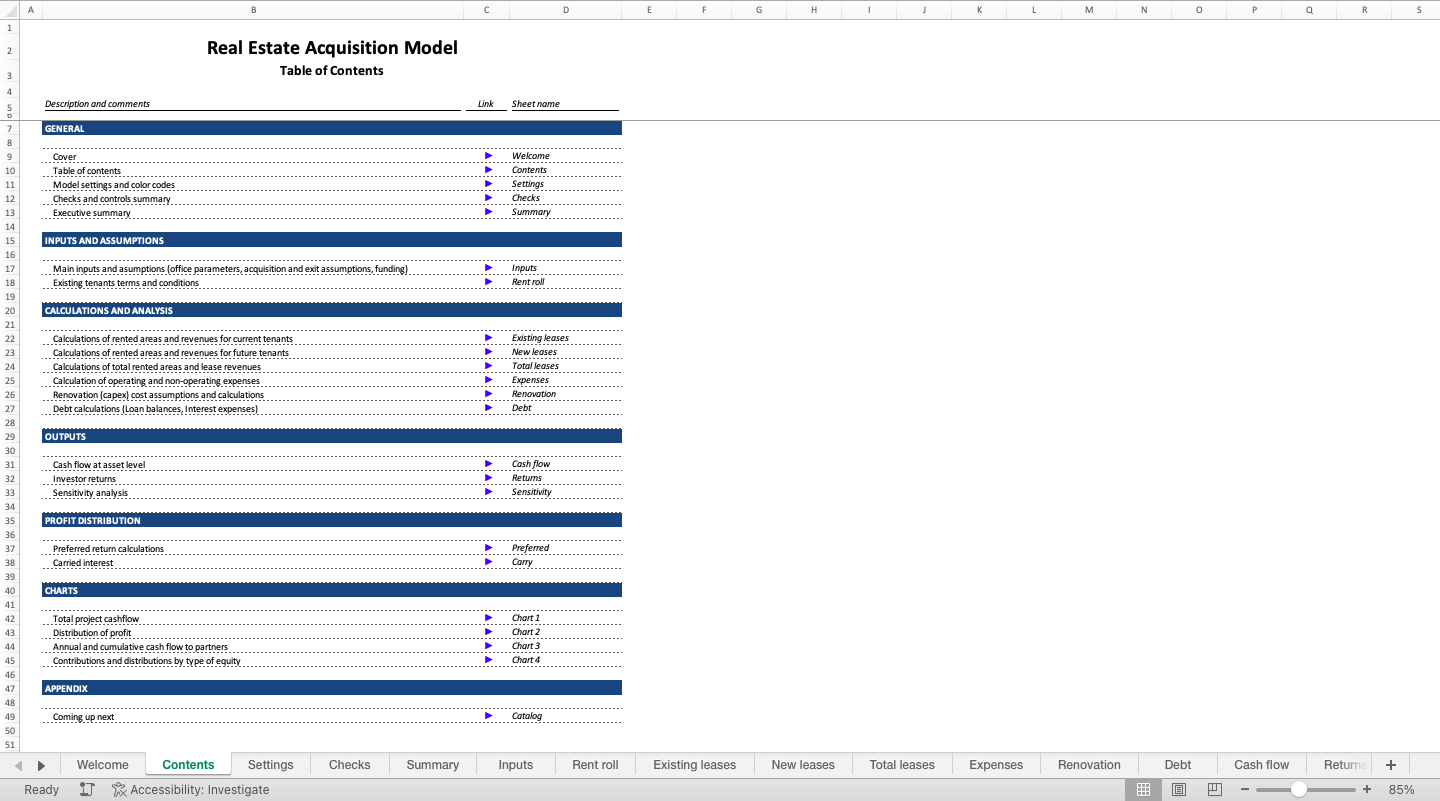

Icrest Models serves different categories of real-estate financial model templates and customized documents.

Check out some of the latest real estate financial model outlines –

Multifamily Real Estate Financial Model

Financial Model For Real Estate (Construction Loan Without Refinance)